When you outsource your accounting, you hand over a part of your financial management to…

GST Calculator Australia Add & Subtract GST Money Matchmaker®

If you operate a business with a GST turnover of $75,000 or greater In Australia, you will have 21 days after exceeding that figure to register your business for GST. In Australia, you must register for GST when your business or enterprise has a GST turnover (gross income minus GST) of A$75,000 or more. You will also need to register your business for GST within 21 days of exceeding that turnover threshold.

What is Australian GST?

The Australia Reverse GST Calculator will provide a table which specifies the product/service price, the product/service GST amount due and the total cost of the product or service in Australia. Whether you’re a business owner or a consumer, our Australian GST calculator will help you make informed decisions and avoid any hidden costs included in the price. Get instant and accurate results with just a few clicks to add or subtract GST from a given amount. The calculator provided on money.com.au is intended for informational and illustrative purposes only.

Enter Price to Calculate

The easiest way to calculate GST on a net price (exclusive of GST) is to multiply the amount by 1.1. To calculate the amount of GST on GST-inclusive goods and services, you’ll need to divide the amount by 11. The main mistake most people can make in calculating the net price of goods is to simply minus 10% from the total price.

- Each time you add new information, the total amount will be updated so you can see the total costs of goods, products and services in Australia inclusive and exclusive or GST.

- Businesses can claim GST credits by lodging a Business Activity Statement (BAS) with the Australian Taxation Office (ATO).

- In Australia, sole traders, self employed individuals need to register for GST if they expect to aud 75,000 in one year.

- You can quickly calculate the GST you can claim through the TRS by using our online GST calculator.

- GST stands for “Goods and Services Tax”, and is a 10% tax applied to the sale of most goods, services, and items in Australia.

GST Free items in Australia

Please note that the Australia GST Calculator is designed to allow you to toggle between quick and Detailed calculations without losing any data that you add to the Detailed GST Table. This is useful if you need to check the individual GST amount on one unit (a single product or service) before adding it to the list of items in the GST table. Please note that the Australia Reverse GST Calculator is designed to allow you to toggle between quick and Detailed calculations without losing any property plant and equipment data that you add to the Detailed GST Table. For example, if the base price of the product is $100, then the total price including GST would be as follows. The Australia GST Calculator will provide a table which specifies the product/service price, the product/service GST amount due and the total cost of the product or service in Australia.

The results generated by this calculator are based on the inputs you provide and the assumptions set by us. These results should not be considered as financial advice or a recommendation to buy or sell any financial product. By using this calculator, you acknowledge and agree to the terms set out in this disclaimer. For more detailed information, please review our full terms and conditions on the website. You can quickly work out the cost of a product excluding GST by dividing the price of the product including GST by 11. You then multiply that figure by 10 to calculate the value of the product excluding GST.

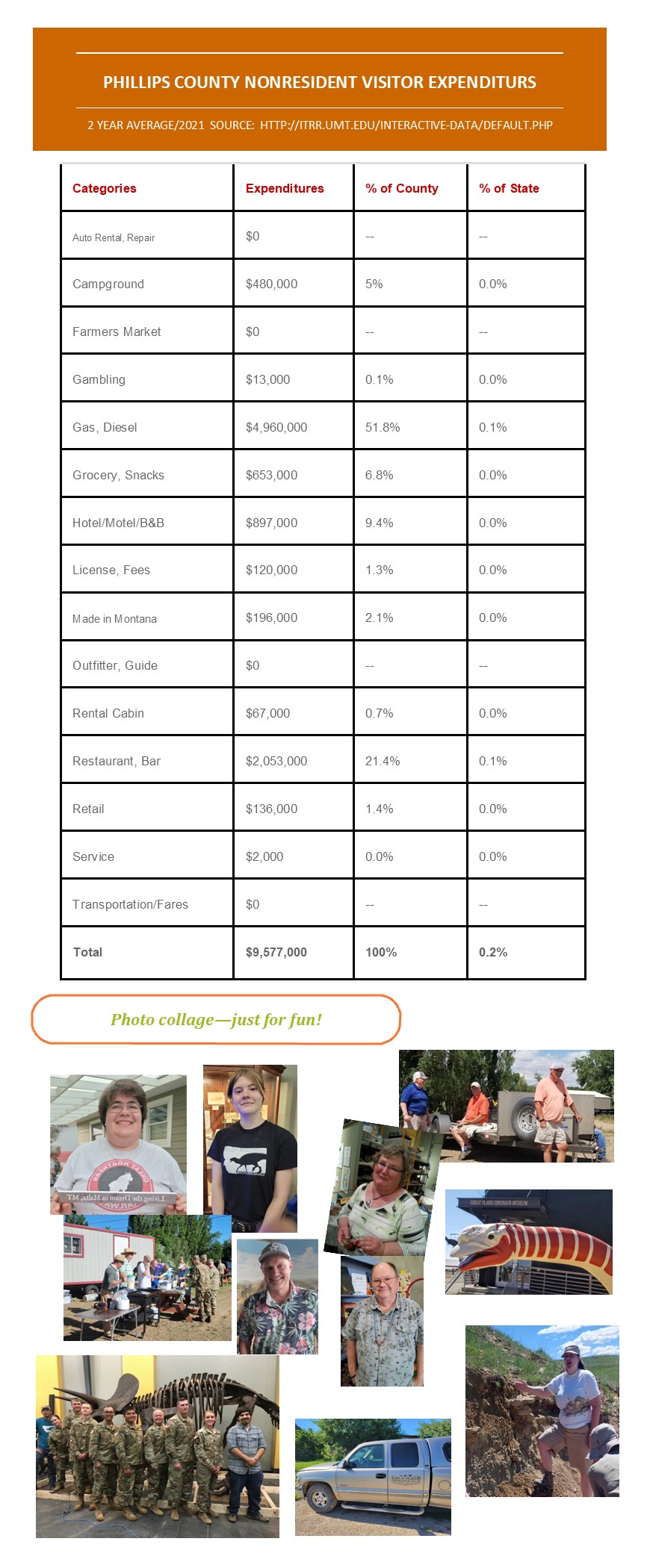

The application of these terms to a particular product is subject to change without notice if the provider changes their rates. The advancements of technology and creation of a largely accessible digital marketplace allow Australians to both provide and access goods and services in a way unforeseen when GST was initially introduced. The table below specifies the relevent GST rates applicable in Australia, these were last updated in line with the published GST rates in 2024. We currently support the following tax years for reverse GST calculation in Australia, if you require additional tax years, please get in touch and we can add them to the list of available tax years. To find out the GST from the total, you simply have to multiply the total amount by the applicable GST rate.

Whilst Money.com.au endeavours to ensure the accuracy of the information provided on this website, no responsibility is accepted how does accounts receivable turnover ratio affect a company by us for any errors, omissions or any inaccurate information on this website. John is the owner of ‘John’s Hardware’ — a hardware and DIY store registered for GST. John imports $20,000 worth of tools into Australia for sale through his business. If you want to quickly calculate or double-check the GST on complex figures, you can use our GST calculator. Once you become eligible for GST registration, you have a 21-day deadline to complete the process.

If you are self-employed, a sole trader, or cb contingent liability a tradie in Australia, you will need to register for GST if you earn more than A$75,000, or if you drive a taxi (regardless of how much you earn). Use our Australian GST Calculator to quickly calculate how GST will apply to your earnings. To compensate for this change, the Australian government introduced GST registration for the ‘Sharing Economy’, which encompasses any type of economic activity conducted by an individual through a digital platform — such as a website or app. Once you have identified the applicable GST amount, multiply it by the current GST rate.

If you provide services or assets through a platform for a fee, you will need to consider how income tax and GST applies to your earnings. You will need to ensure that you account for all income and provide this information to Australian Tax Office on your tax return, and register for GST if you meet any of the standard GST registration requirements for businesses or sole traders. Businesses — including non-profit organisations and self-employed individuals — will be required to register for GST if they meet certain conditions listed below. If they fail to register for GST when you are required to, you may be forced to repay the GST on any sales made from the date you were required to register, including penalties and interest.